Make It Better

Debt Relief

We all deserve a second chance. Fortunately for us, federal law provides people that second chance, to start over, by wiping away many of their debts. If you are overloaded with debt and harassed by creditors, find out what your options are from a bankruptcy attorney. The attorney can give you straight answers to your bankruptcy questions and help you relieve the burden of debt.

Bankruptcy is the legal process allowing an individual or company to eliminate debt and stop creditor harassment. Bankruptcy provides the opportunity to legally rid of debt, when few other alternatives are available. Bankruptcy is used by individuals, companies, businesses and major corporations to rid themselves of excess debt or reorganize their debt to more manageable levels, all allowing them to get their financial circumstances back on track. There is no sense belaboring and agonizing over past financial decisions or circumstances. Bankruptcy allows for that second chance and a “fresh start” to move forward with our lives, debt free.

Maybe you lost your job and you have been unable to find employment again or your income is less with new employment. Maybe you recently went through a divorce and the smaller-than-normal income, coupled with the unpaid bills and legal fees and other unexpected expenses have left you strapped. Maybe you experienced an unexpected financial loss or circumstance, leaving you with more financial responsibilities than you can handle.

Or maybe the bills from a medical condition or accident are draining your savings. You would be far from alone if this were the case. In fact, medical bills are one of the leading causes of personal bankruptcy.

These are some of the most common causes of excess debt leading to a bankruptcy and they are nothing to be ashamed of. Most of the time, the cause of serious financial debt is out of your hands; it is something you have little to no control over. It is merely a result of unfortunate circumstances, beyond our control and not our fault.

Warning Signs: How to Spot Debt Issues Before It’s Too Late

It is not always easy to know when your debt levels have taken you to that point of no return. If you show any of the following signs, you need to contact a bankruptcy attorney immediately. If you wait too long, as many do, you may not even be able to afford a bankruptcy attorney. Your bank account may be garnished or your paycheck may be garnished. Do not wait until things get worse. Get help now.

Here are some warning signs to look out for:

- You cannot afford the essentials, like food or gas, and you are charging these to a credit card to pay off later.

- You are living paycheck to paycheck.

- You are running a negative bank account balance.

- You are late on your payments.

- You are not eating as much because you can’t afford to buy as much food.

- You have had to stop doing the things you love to do, like spending time with your friends or family, because you don’t have the money.

- You are being harassed by bill collectors.

If any of these things are taking place, call me.

Chapter 7 and Chapter 13 Bankruptcy

There are two main types of bankruptcy that can help get you out of debt. The first and best option, if possible, is a Chapter 7 bankruptcy, sometimes referred to as a “Fresh Start” or what I call a “true bankruptcy” because it allows you to eliminate most, if not all of your debt, without having to pay any of the debt. You can only file for Chapter 7 bankruptcy once every eight years. Also, your earnings may be too high, which would make you ineligible for debt relief through a Chapter 7. So, while Chapter 7 may be the best option to rid yourself of your debt, it is not always possible, but we always look to a Chapter 7 first on behalf of our clients.

Essentially, Chapter 7 bankruptcy allows you to eliminate the majority of your debt, while usually being able to keep your house or condominium and car, if you so desire. Debt is usually classified as being either “unsecured” or “secured.” Unsecured debt is generally eliminated in a Chapter 7 bankruptcy. Secured debt, which can also be eliminated in a Chapter 7 bankruptcy, needs to be paid, IF you want to keep the collateral (the house, condominium, car or motorcycle) that is used to secure the payment of the secured debt. So, if you wish to keep your house, condominium, car or motorcycle, and you have a mortgage on your house or condominium or have taken a loan to buy your car or motorcycle, you must continue to make the payments on that loan, to the creditor who is secured. On the other hand, if you cannot afford the payments or do not wish to keep the house or condominium, car or motorcycle (the collateral) because, for example, it is worth less than the outstanding balance of the secured debt, Chapter 7 allows you to also eliminate the secured debt BUT you must also return or surrender the collateral to the creditor.

Chapter 13 bankruptcy is the other common type of bankruptcy for individuals. Chapter 13 bankruptcy can almost always be filed, subject to certain specific restrictions. Unlike Chapter 7 which allows you to eliminate debt, Chapter 13 is a repayment plan, allowing you to pay back debt, over a period of time, without interest. For example, if you have a significant amount of property, assets or equity in property, or if you make “too much money,” you may not qualify or be able to seek debt relief through a Chapter 7 bankruptcy, leaving you with the alternative of having to pay back some or all of your debt through a Chapter 13 bankruptcy. Also, certain debt, like parking tickets and government fines, cannot be eliminated in a Chapter 7 and can only be addressed in a Chapter 13 bankruptcy.

In general, a Chapter 13 bankruptcy consolidates your debt so you can pay some or all of it back, through a payment plan, usually lasting from 3 to 5 years, allowing you to make one monthly payment you can afford.

Many people ask: “what happens to my property or assets if I file a bankruptcy?” In a Chapter 13 bankruptcy you generally get to keep your assets, again, because you are making monthly payments on your debt. In a Chapter 7, as we like to say: “you can keep your stuff but you can’t have too much stuff.” In other words, there are limits to the value of property or type of property you can keep and still eliminate debt with a Chapter 7 bankruptcy. The law provides for exemptions (the type of assets you can keep and the limits to the value of those assets), which allow you to keep assets and still eliminate you debt. For example, you may be able to keep your house, condominium or vehicle, depending upon their value or the equity you may have in them. For most people, depending upon the type of assets they have or the equity in those assets, the exemptions will allow them to keep all their assets, which means their property will not be taken away from them, if they file a Chapter 7 bankruptcy.

Some Common Misconceptions and Truths About Bankruptcy

Many people think receiving debt relief by filing bankruptcy will result in losing their job, ruin their career or ruin their credit. They worry they will lose everything they own—house, vehicle, retirement plan. They are even afraid they will never again receive any credit, to open a credit card account, buy a car or buy a home or fear they cannot rent an apartment, after filing bankruptcy.

None of these misconceptions are true. Bankruptcy relief has nothing to do with your job or career and it should not be a factor your current employer, any future employer or landlord considers. Getting rid of debt, through the legal process of bankruptcy, more often helps people, by providing them their fresh start to rebuild their credit and then be able to pay bills on time, as they are not over burdened with excess debt. By paying bills on time and not having excessive debt, potential creditors, lenders and landlords will realize you are taking control of your financial situation, after having filed for bankruptcy and eliminated your debt, where now you are essentially debt-free and able to pay your bills moving forward, including being able to pay for a new credit card or pay rent.

We have found over the years, many of our clients, after receiving a bankruptcy discharge, are solicited by creditors, banks and lenders with credit offers, as they are now debt-free and able to assume a reasonable amount of debt and make payments on new credit or a new loan, as long as they have income. Many of our clients also inform us they are buying a vehicle soon after a bankruptcy or buying a home, a few short years after a bankruptcy, as they are debt-free after the bankruptcy, have rehabilitated their credit, by paying bills on time, and then qualifying for a loan to buy a vehicle or qualifying for a mortgage to buy a home.

In many ways, eliminating debt through bankruptcy gives you a new and almost immediate opportunity to reestablish credit or gain new credit and move forward with your financial life, becoming an active and productive debt-free consumer.

Bankruptcy gives you the opportunity to get a “fresh start,” to get on with your financial life and make things better.

For More Information

For more information on bankruptcy, as well as the official forms for filing, check out the following helpful sites:

- U.S. Trustee Program/Dept. of Justice

- U.S. Trustee Program/Dept. of Justice

- Northern District of Illinois | United States Bankruptcy Court

- Annual Credit Report

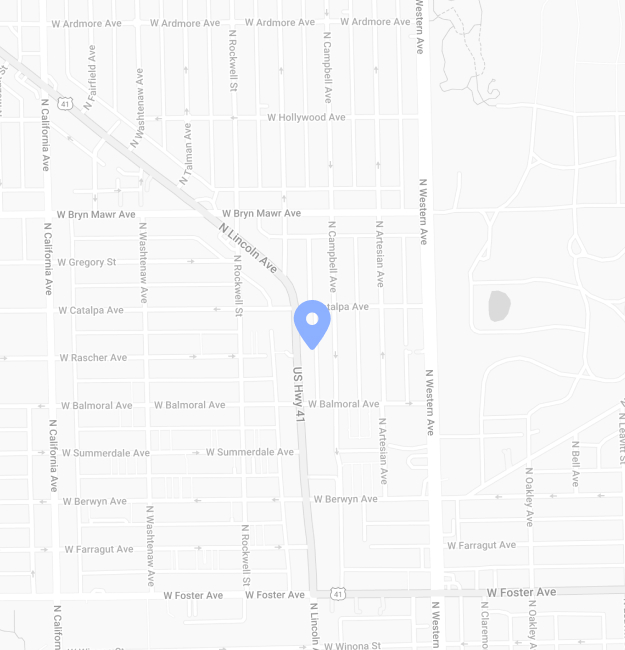

However, these sites are not to be used in place of legal advice. If you live in the Chicago area and are in financial trouble, it is critical you talk with a bankruptcy attorney who can discuss your specific situation with you and best guide you as to what options are available to you under the law.